Blog

How do you know when you’re ready to hire a virtual CFO?

Do you have hesitations as to whether or not your business is ready to hire a virtual CFO?

Read this blog to help identify the 10 signs that may indicate that it’s time for your business to engage a virtual CFO.

Virtual CFO services - a sensible risk management strategy

Virtual CFO services provide resilience in a world of disruption and are a sensible risk management strategy for managing resource cost inflation

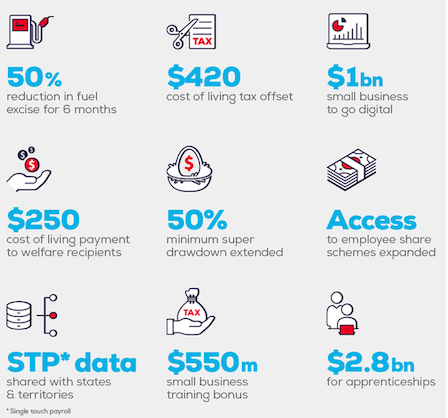

Snapshot of the Federal Budget 2022-23

Handed down on 29 March, here are the key takeaways from the 2022-23 Federal Budget on measures that may impact businesses.

Fuel excise reduction for six months

New measures to address cost-of-living (including increasing the low-middle income tax offset) and assist new parents

New tax deductions for businesses to encourage digital adoption

A strong focus on skills and training to upskill the Australian workforce including new tax deductions for businesses

Apprenticeship subsidy extension

STP data sharing with states & territories

Electronic invoicing (e-invoicing)

Electronic invoicing (e-invoicing) is the automated digital exchange of invoice information directly between a supplier's and buyer's software based on an agreed standard.

With e-invoicing:

businesses will no longer need to generate paper-based or PDF invoices that must be printed, posted or emailed

buyers will no longer need to manually enter or scan these into their software.

Single Touch Payroll (STP) Phase 2

STP Phase 2 is mandatory to start reporting on 1 January 2022.

The expansion of STP reduces the burden for payroll providers who need to report information about employees to multiple government agencies as it streamlines obligations to these agencies by removing the need for manual reporting.

Stapled super funds for employers

There was a recent change that means to comply with choice of fund rules you may need to do something extra when a new employee starts to work for you.

Previously, if a new employee doesn't choose their own super fund, you could pay super contributions for them to your default fund.

From 1 November 2021, if you have new employees start and they don't choose a specific super fund or your default fund, you need to request their 'stapled super fund' details from the ATO.

Director ID applications now available

A director ID is a unique identifier that directors need to apply for only once and keep forever. It will help to prevent the use of false or fraudulent director identities.